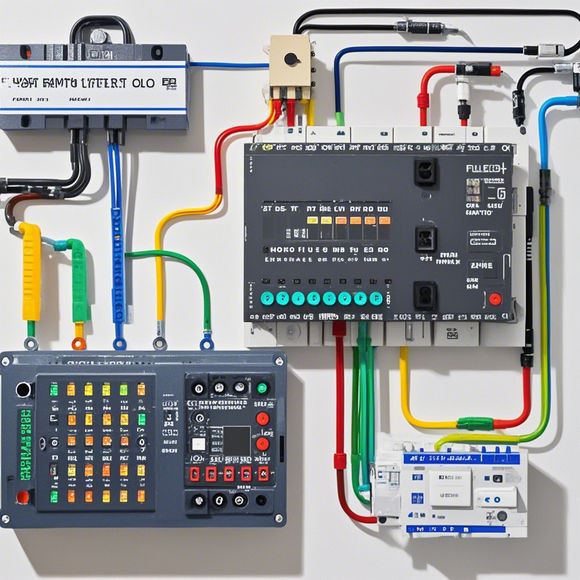

PLC Controller Tax Classification Codes for Import and Export Businesses

In order to comply with international trade regulations, it is important for import and export businesses to accurately classify their PLC controllers according to the applicable tax codes. This is done through the use of specific classification codes that are assigned based on the type, function, and intended use of the PLC controller. These codes help determine the appropriate tariff rates, which can significantly reduce import and export costs while maintaining compliance with domestic and international standards and regulations. Therefore, it is crucial for business owners to stay up-to-date on changes in these codes, as any misclassification could result in significant financial penalties or other legal consequences.

Introduction:

In the global marketplace, understanding and utilizing tax classification codes for PLC controllers is crucial for any import and export business. The ability to accurately identify the correct tax rate for your products can significantly impact your profitability. This guide aims to provide a comprehensive overview of the different tax classifications applicable for PLC controllers, along with practical tips for managing and complying with these regulations. By following this guide, you'll be equipped to navigate the tax landscape effectively, minimizing potential compliance risks and maximizing your financial returns.

Tax Classification for PLC Controllers:

1、Electronic Product (EPL) Classification:

- EPL items are classified as electronic devices that require specialized electrical equipment certifications. These include PLC controllers, automation systems, and industrial control systems.

- Example: An industrial automation system consisting of a PLC controller and sensors might be classified under EPL item due to its complex nature and the need for certification.

2、Electronic Controlling Devices (ECD):

- ECDs refer to devices used for controlling or monitoring processes in manufacturing or other industrial applications, including PLC controllers.

- Example: A production line may consist of an array of automated machines controlled by an ECD PLC controller, which should be classified accordingly.

3、General Purpose Computers (GPC):

- GPCs are general-purpose computer systems that can perform various functions such as data processing, storage, and networking.

- Example: A GPC PLC controller might be used in manufacturing environments where it serves as a central processing unit for controlling multiple machine tools and sensor data collection.

4、Other Categories:

- Depending on specific industry standards and requirements, other categories may apply for certain types of PLC controllers, such as medical devices or automotive control systems.

- Example: A medical PLC controller designed for surgical procedures may be classified under "Medical Device" due to its specialized use and regulatory considerations.

Compliance Tips:

1、Keep up-to-date with Industry Regulations:

- Regularly review and stay informed about changes in tax classification regulations for PLC controllers in your industry. This can help ensure you're compliant and avoid potential fines or penalties.

- Example: For instance, if new regulations specify that PLC controllers must be labeled as EPL items, businesses should update their documentation accordingly.

2、Consult with Professionals:

- Consider engaging with certified tax advisors or consulting firms specializing in PLC controller taxation. They can provide valuable advice on how to correctly classify and manage your PLC controllers within the tax code.

- Example: A firm specializing in international trade compliance could help streamline the process of determining the correct classification for a range of PLC controllers in different countries.

3、Use Technology Tools:

- Embrace technology solutions like automated tax codes checkers to quickly and accurately classify your PLC controllers. These tools can save time and reduce human error during the tax filing process.

- Example: Using a tool that provides real-time tax code updates could significantly expedite the identification process for newly developed PLC controller models that have yet to be officially classified.

Conclusion:

By following this guide, you'll gain an understanding of the various tax classifications applicable for PLC controllers and practical tips for managing them effectively. Remember, proper tax classification is essential for ensuring compliance with international regulations and maximizing your profits. With ongoing research and collaboration with professionals, you'll be well-equipped to handle the complexities of taxation for your PLC controllers, safeguarding your business interests and ensuring a smooth operation within the ever-changing global tax landscape.

Content expansion reading:

As an experienced foreign trade operator, it’s crucial to have a thorough understanding of tax classification codes, especially for PLC controllers. These codes are essential for ensuring proper tax compliance and avoiding any penalties or delays in international trade transactions.

In the realm of automation and industrial control systems, PLC controllers play a pivotal role. They serve as the brains of the operation, controlling various processes and functions within machines, equipment, and entire production lines. Given their complexity and wide range of applications, it’s important to classify them correctly for tax purposes.

When it comes to tax classification codes for PLC controllers, there are several factors to consider. Firstly, the type of PLC controller is a key factor. There are various types available in the market, ranging from small standalone units to large, sophisticated systems with advanced features and capabilities. Each type has its own unique set of characteristics and functions, which must be considered when assigning a tax classification code.

Secondly, the application of the PLC controller also plays a role in tax classification. Different industries and sectors use PLC controllers for various purposes. For instance, manufacturing, automotive, and oil and gas industries rely heavily on PLC controllers for their operational efficiency and productivity. Each industry has its own set of specific requirements and processes, which must be reflected in the tax classification codes.

Moreover, the country-specific tax regulations and policies also impact the tax classification codes for PLC controllers. Different countries have their own unique tax systems and regulations, which may vary in terms of tax rates, tax brackets, and even the classification criteria itself. Therefore, it’s essential to have a thorough understanding of the tax laws and regulations of the country in which the PLC controller will be used or traded.

To ensure proper tax classification of PLC controllers, it’s advisable to consult with tax experts or authorities in the relevant country. They can provide guidance on the specific tax classification codes applicable to PLC controllers based on their type, application, and the country’s tax laws and regulations.

In addition to tax classification codes, it’s also important to consider other factors related to international trade transactions involving PLC controllers. For instance, customs duties, import/export licenses, and other trade barriers may affect the cost and profitability of such transactions. Therefore, it’s essential to have a comprehensive understanding of these aspects as well.

In conclusion, tax classification codes for PLC controllers are crucial for ensuring proper tax compliance in international trade transactions. It’s essential to consider various factors such as the type of PLC controller, its application, and the country-specific tax regulations and policies. Consulting with tax experts or authorities is advisable to ensure accurate classification and avoid any penalties or delays. Understanding these aspects will help in smooth and profitable international trade transactions involving PLC controllers.

Articles related to the knowledge points of this article:

PLC Programming for Automation Control in the Manufacturing Industry

How to Use a PLC Controller for Your Business

Plumbers Rule! The Role of PLC Controllers in the World of Waterworks

The Role of Programmable Logic Controllers (PLCs) in Foreign Trade Operations

PLC Controllers: A Comprehensive Guide to Understanding Their Prices