Understanding and Managing the Taxation of PID Controllers in Global Trade

在全球化贸易中,了解并管理PID控制器的税收问题显得尤为重要。我们需要明确PID控制策略的核心原理。它通过调整系统的输入、输出和内部参数来优化系统性能,实现对过程变量的有效控制。考虑到不同国家和地区的税收政策差异,我们需要深入理解各种税收条款及其对PID控制器制造商的影响。增值税(VAT)和关税可能会成为成本的重要组成部分。我们还需要考虑税收优惠政策,如减免或退税措施,以减轻企业负担。为了应对这些挑战,建议采取以下策略:加强与税务顾问的合作,定期进行税务规划,以确保税收合规;密切关注国际税收法规的变化,以便及时调整经营策略。理解和管理全球贸易中的PID控制器税收问题是确保企业可持续发展的关键之一。

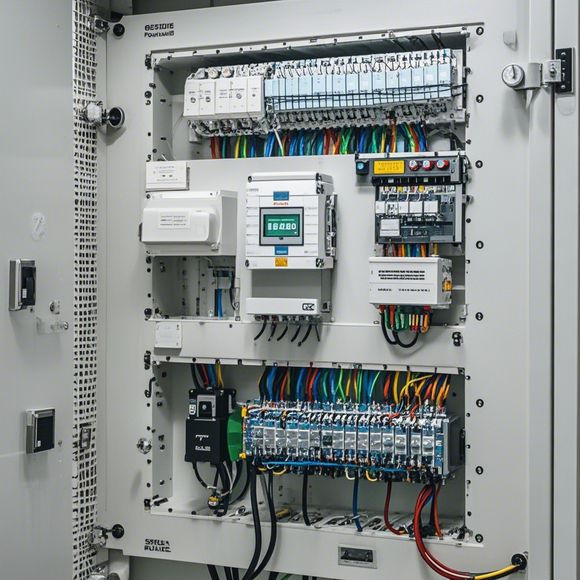

In today's globalized economy, understanding the tax implications of imported and exported products is crucial for successful business operations. Among the myriad categories of goods and services, one that has gained significant attention in recent years is the classification of Programmable Logic Controllers (PLC), which are essential for controlling industrial processes in various industries. As a responsible trader, it is imperative to familiarize yourself with the relevant tax codes applicable to these controllers to avoid unforeseen financial burdens and maintain compliance with local and international regulations. This guide aims to provide you with an insightful overview of the tax landscape related to PLC controllers, highlighting the key considerations and steps to navigate this complex area effectively.

Identifying the Tax Inherent in PID Controllers

Firstly, it's crucial to understand that PLC controllers come under a broad range of tax classifications based on their intended use, origin, and value. The primary categories include:

General Expenses: These refer to the costs incurred during the procurement, production, distribution, and installation of PLC systems.

Customs Duties: This covers taxes and fees charged by customs authorities on the importation of goods into foreign territories.

VAT: Value-Added Tax, which applies to all goods and services sold within a country's borders, including those imported from abroad.

Import Duty: A tax imposed on the import of goods into a specific country.

Export Duty: A tax levied on the export of goods or services to another country.

Taxes on Services: This category includes taxes on services provided by companies, such as consultancy, training, and maintenance services.

Calculating the Tax Implications

When determining the tax implications of PLC controllers, it's essential to consider several factors, including the type of controller (e.g., industrial, commercial) and its intended use (e.g., automation, process control). The complexity of the tax code also varies depending on the jurisdiction where the controller will be used, as different countries impose varying levels of taxation on imported goods.

To calculate the potential tax savings or liabilities associated with your operations, you can follow these steps:

1、Identify the Type of PLC Controller: Determine if your controllers fall into one of the predefined classifications or if they need to be reclassified based on their intended use.

2、Research Local Tax Rates: Conduct a thorough study of the local tax rates applicable to the specific PLC controllers you wish to import or export.

3、Comprehensive Tax Calculation: Apply the appropriate tax codes to your calculations, taking into account any exemptions or deductions available to reduce your tax liability.

4、Consult with Professionals: Consider engaging with tax experts or consultants who specialize in PLC controllers to gain insights into the most efficient ways to manage and minimize tax obligations.

Strategies for Minimizing Tax Burdens

While understanding the tax landscape is crucial for avoiding penalties and ensuring compliance, there are several strategies you can adopt to minimize your tax burdens:

Negotiate Qualified Tax Credits: If applicable, explore tax credits or other incentives offered by your government or relevant agencies that may lower the overall tax liability.

Optimize Export Pricing: Use advanced tax planning techniques, such as using tax havens or strategically structuring your transactions to minimize the amount of tax paid on your sales.

Consider International Tax Cooperation: Partner with international businesses to share information about VAT and other applicable taxes, enabling you to negotiate favorable rates and payment schedules.

Utilize Technology: Embrace modern technologies like artificial intelligence and blockchain to streamline your tax processes, ensuring accuracy and timely submissions.

Ensuring Compliance and Building a Strong Financial Footprint

As a trader, it's essential to ensure not only compliance but also a strong financial footprint by managing your tax liabilities effectively. By understanding and adhering to the tax laws related to PLC controllers, you can mitigate potential financial risks while maintaining a competitive edge in your industry. Remember, staying informed about changes in tax regulations and adopting proactive strategies will enable you to navigate the complexities of the global trade landscape with confidence and ease.

In conclusion, managing the tax implications of imported and exported PLC controllers requires a multifaceted approach that involves identifying the tax inherent in your purchases, calculating the potential tax savings or liabilities, and implementing strategies to minimize your tax burdens. By staying updated on tax policies, leveraging professional advice, and adopting proactive tax management practices, you can build a solid financial foundation for your business while complying with local and international regulations. Remember, success in trade is not solely dependent on price or quality, but equally critical is understanding the nuances of the tax system. So, stay informed, be adaptable, and always prioritize your financial well-being.

Content expansion reading:

Content:

Hey there, fellow professionals in the world of exports and imports! Today, we're diving into a topic that might not be the most exciting, but it's definitely essential for anyone dealing with PLC controllers: tax classification codes. Now, I know what you're thinking – who wants to talk about taxes when we could be discussing the latest trends in automation or the coolest features of the newest PLC models? But trust me, understanding these codes is crucial for ensuring smooth operations and avoiding any unexpected surprises during the import and export process.

So, let's get down to business. What exactly are PLC controller tax classification codes? Well, they're essentially a set of numbers and letters that categorize your PLC controllers for tax purposes. These codes are used by customs authorities to determine the correct tax rate that applies to your product when it crosses international borders. Each country has its own system for classifying goods, and PLC controllers can fall under various categories depending on their specific features, functions, and intended use.

Why is this important? Well, imagine you're importing a high-tech PLC controller that's packed with advanced features. If you classify it incorrectly, you could end up paying more in taxes than you need to, or worse, you might not comply with local regulations, which could lead to delays or even the return of your goods. On the flip side, if you're exporting, getting the tax classification right is key to staying competitive and maximizing your profits.

So, how do you go about finding the right tax classification code for your PLC controller? It's not as simple as looking up a product number in a catalog. You need to consider the technical specifications, the materials used, and the intended application of the controller. This information is then used to determine the correct code based on the Harmonized System (HS) or the local equivalent.

The HS is a standardized system used by most countries to classify goods for customs and tax purposes. It's a six-digit code, and while it's not always straightforward to determine the correct HS code, there are resources available to help. For example, the World Customs Organization provides guidance, and many countries have their own customs authorities that can assist you in finding the correct code for your PLC controller.

Once you have the HS code, it's important to check if there are any additional requirements or specific codes for your product in the country you're importing to or exporting from. Different countries may have their own additional digits or codes that further refine the classification, so it's essential to do your homework and ensure you're using the most accurate and up-to-date information.

In conclusion, while tax classification codes might not be the most thrilling aspect of our work, they're a critical piece of the puzzle when it comes to the successful import and export of PLC controllers. Taking the time to understand and correctly apply these codes can save you time, money, and a whole lot of headaches down the line. So, the next time you're preparing to ship a PLC controller, make sure you've got your tax classification code in hand – it's a small detail that can have a big impact on your bottom line.

Remember, knowledge is power, especially when it comes to navigating the sometimes complex world of international trade. Stay informed, stay compliant, and keep those goods moving smoothly across borders!

Articles related to the knowledge points of this article:

Smart Manufacturing Solutions with PLC Integrated Machinery

PLC Controller Selection Guide for Foreign Trade Operations

The Role of Programmable Logic Controllers (PLCs) in Foreign Trade Operations

Connecting a PLC Controller to Your Computer

PLC Controllers: A Comprehensive Guide to Understanding Their Prices