PLC Controllers Tax Category Identification Guideline

Here is a simplified version of an abstract for your content:"This guideline provides a clear and concise method for identifying the tax categories for PLC controllers. It explains how to categorize these devices based on their functionalities, materials, and other factors, which are important for calculating the appropriate tax rates. By following this guide, users can ensure that they are paying the correct amount of taxes, while also complying with any relevant regulations or laws. This guide should be easily understood by anyone who needs to use it in their daily work."

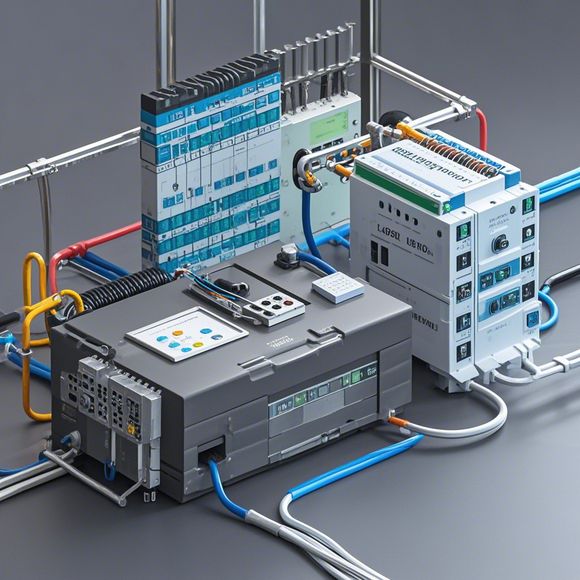

In the world of international trade, understanding and correctly identifying the applicable tax categories for products is essential. For plc (programmable logic controller) controllers, which are commonly used in industrial automation systems, this knowledge can help you comply with local regulations and ensure a successful import and export process. In this guide, we'll delve into the various types of tax classifications that apply to plc controllers. By following these guidelines, you can avoid any potential issues or fines associated with incorrect tax identification, ensuring your business operations run smoothly. So let's get started!

Understanding the Tax Classification of PLC Controllers

1、General Purpose Digital Controllers

- These controllers are designed to control a wide range of processes and applications. They typically have fewer inputs and outputs, making them more user-friendly and cost-effective.

- When it comes to tax classification, GPD controllers fall under the 'Electronic Product' group, which includes devices that are used in manufacturing, processing, and transportation industries.

2、Programmable Logix Controllers

- These controllers offer more advanced features such as programmable logic blocks, input/output modules, and advanced functions like PID control.

- When it comes to tax classification, PLD controllers are categorized under the 'Manufacturers' category since they are manufactured by specific companies.

3、Fieldbus Control Systems

- Fieldbus systems use wireless communication technologies to connect devices over long distances without physical cables.

- Tax classification for Fieldbus systems is often based on the type of network used, such as Profinet or EtherCAT. These systems are also classified under 'Electronic Products' due to their use in manufacturing and industrial automation.

4、Other Types of PLC Controllers

- Depending on the specific model and features of the PLC controller, there may be additional tax classifications available.

- For example, some controllers may be classified under 'Machine Tools' or 'Automation Systems' depending on their intended use and application.

Importing PLC Controllers: Knowing Your Tax Structure

When importing PLC controllers into your country, it's crucial to understand the tax structure and regulations applicable to your location. Here are a few key points to keep in mind:

1、Examining Local Tax Rates

- Before placing an order for PLC controllers, it's essential to research the local tax rate for each country where your products will be sold. This information can be found on official government websites or consulted with a tax advisor.

- Higher tax rates may apply if you plan to ship your products overseas. It's advisable to calculate the total cost of the product including taxes, fees, and shipping expenses to ensure profitability.

2、Compliance with International Standards

- Ensure that your products meet international standards before importing them. This includes conformity assessments and certifications required by different countries or regions.

- If your PLC controllers do not meet these standards, you may face delays in obtaining necessary permits or inspections. It's better to invest time and resources upfront to avoid costly delays later.

3、Customs Duties and Taxes

- Import duties and taxes vary from one country to another. Some countries may impose additional charges based on the value of your imported goods.

- To minimize these costs, it's advisable to negotiate with customs authorities or engage a customs broker who specializes in navigating complex import regulations.

4、Exporting PLC Controllers: Balancing Cost and Benefits

- While it's tempting to sell your products overseas, it's important to weigh the costs involved, such as tariffs, VAT, customs duties, and other fees.

- Consider whether the benefits outweigh the costs when deciding whether to export your products. If the profits from selling abroad are significant, investing in proper documentation, compliance efforts, and marketing strategies could make the investment worthwhile.

5、Staying Compliant with Changes in Tax Regulations

- The tax landscape can change rapidly, so it's essential to stay updated on any new regulations or changes in existing ones.

- This can include updates to tax codes, changes in tariff rates, or shifts in market preferences. Staying informed helps you adjust your strategy and maintain profitability while complying with evolving tax policies.

In conclusion, understanding the tax classification and regulatory requirements for plc controllers is critical for any exporter or importer. By following the guidance above and staying informed about changes in tax policies, you can navigate the complexities of international trade effectively. Remember, being proactive in managing your tax affairs can help you achieve greater success in your business endeavors.

Content expansion reading:

Hey there, fellow professionals! Today, we're diving into the world of PLC controllers and their tax classification. Now, I know what you're thinking – tax codes can be a real snooze-fest. But stick with me, because understanding these codes can save you time and money when it comes to managing your inventory and ensuring compliance with local regulations.

So, what exactly is a PLC controller? It's a programmable logic controller, a type of industrial computer designed to automate various processes. They're used in manufacturing, assembly lines, and any industry that requires complex control sequences.

When it comes to taxes, PLC controllers can be classified under various codes depending on the specific product and its use. For example, they might be classified as industrial machinery, electrical equipment, or even computer equipment. Each category comes with its own set of tax rates and exemptions, which is why it's crucial to get it right.

Take, for instance, the Harmonized System (HS) code, which is used by the International Customs Cooperation Council. This code is a standardized system that categorizes goods for customs and tax purposes. For PLC controllers, you might see codes like 84.71 for industrial process control machines or 85.37 for programmable controllers.

But it's not just about the HS code. Domestic tax codes can vary even more. In the United States, the North American Industry Classification System (NAICS) is used to classify businesses and products for statistical purposes. For PLC controllers, you might find them under codes like 334511 for electronic computer manufacturing or 335312 for electrical equipment manufacturing.

Now, here's the thing – incorrect tax classification can lead to overpaying taxes or, even worse, non-compliance penalties. That's why it's essential to consult with a tax professional who can help you determine the correct tax classification for your PLC controllers based on their specific features and your business operations.

In conclusion, while tax classification might not be the most exciting part of our job as外贸运营, it's definitely one of the most important. By taking the time to understand these codes, we can ensure that our businesses are running efficiently and within the bounds of the law. So, let's keep learning and stay ahead of the game!

Articles related to the knowledge points of this article:

How to Use a PLC Controller for Your Business

The Role of Programmable Logic Controllers (PLCs) in Foreign Trade Operations

Connecting a PLC Controller to Your Computer

PLC Controllers: A Comprehensive Guide to Understanding Their Prices