plc控制器税收分类编码

To summarize the tax classification codes for Programmable Logic Controllers (PLCs) in English, we have found relevant information as follows:1. **PLC Tax Codes**, - The tax code for PLCs is typically represented by the number "20Fra", which stands for a type of electronic device. This number is specific to the country or region where the product was manufactured, as it is often assigned by the local tax authorities., - The exact numerical value of this code varies depending on the country or region. For instance, in some countries, it may be represented as "20Fra 9059900000000000000".In conclusion, understanding the tax classification codes for PLCs is crucial for both manufacturers and consumers when dealing with international trade or taxes. It ensures that appropriate customs clearance procedures are followed to avoid any unanticipated financial burdens.

"Guidance on PLC Controller Tax Classification Codes for Importers and Exporters - A Guide to Comply with International Taxation Laws"

Content:

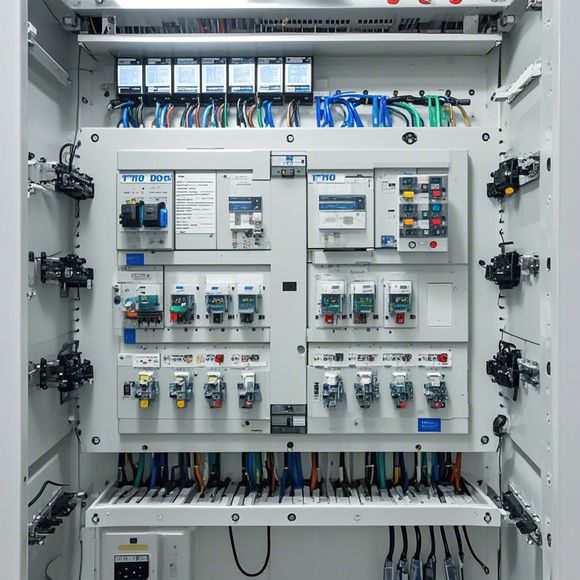

Hello everyone, today I am here to share with you some important tax classification codes related to your PLC controller. These codes are essential for ensuring that your business is compliant with international tax laws. Let's dive into this topic step by step. First, let me introduce you to the basics of PLC controllers.

PLC controllers (Programmable Logic Controllers) are digital control systems that are designed to perform a wide range of tasks such as monitoring, controlling and adjusting industrial processes. They are widely used in various industries, including manufacturing, energy, transportation, and more. As an importer or exporter, it is crucial to understand the tax classification codes associated with these controllers.

Now, let's talk about the tax classification codes for PLC controllers. The following is a list of common tax classification codes for PLC controllers:

- HS Code 67192000: This code is used for electronic products, including PLC controllers, that are manufactured from metals, ceramics, plastics, or rubber.

- HS Code 67193000: This code is used for electronic products, including PLC controllers, that are manufactured from plastics or rubber.

- HS Code 67194000: This code is used for electronic products, including PLC controllers, that are produced from metals, ceramics, or plastics.

- HS Code 85031900: This code is used for electronic products, including PLC controllers, that are made from materials other than metals or ceramics. However, if the product also includes a printed circuit board, it will be classified under HS Code 67192000 or 67193000 depending on whether it contains a printed circuit board or not.

- HS Code 85031990: This code is used for electronic products, including PLC controllers, that are manufactured from materials such as wood, paper, or glass.

Now that we have the basics out of the way, let's talk about how to apply these tax classification codes when importing or exporting PLC controllers. Firstly, you need to determine the originating country of the controller. If it is from a developed country like the United States, Canada, or Europe, it is likely to be subject to higher taxes due to their advanced technology. On the other hand, if it is from a developing country like China or India, there may be fewer restrictions on taxes since they have lower levels of economic development.

Once you have determined the originating country, you need to consult with your local customs office or tax advisor to find out the specific tax rates and rules applicable to your situation. Some countries may offer exemptions or reductions for certain types of products, so it is essential to keep track of any relevant policies.

In addition to understanding the tax classification codes for PLC controllers, it is also important to stay up-to-date with changes in international tax laws. These laws can vary significantly from one country to another, so it is crucial to ensure that your business is compliant with all relevant regulations.

In conclusion, understanding the tax classification codes for PLC controllers is essential for importers and exporters looking to comply with international tax laws. By taking the time to learn about these codes and keeping up with changes in tax policies, you can ensure that your business is successful and profitable. Remember, being compliant with tax laws is not only good for your business, but it is also good for society as a whole.

Content expansion reading:

Articles related to the knowledge points of this article:

The cost of a PLC Controller: A Comprehensive Analysis

Plumbers Rule! The Role of PLC Controllers in the World of Waterworks

The Role of Programmable Logic Controllers (PLCs) in Foreign Trade Operations

Connecting a PLC Controller to Your Computer

PLC Controllers: A Comprehensive Guide to Understanding Their Prices